Spring 2019 - Vol. 14, No. 1

Urgent Care: Meeting a Growing Demand

Wynne Harris DiCamillo

Wynne Harris DiCamillo

Susan Wynne

Senior Vice President Business Development

Penn Medicine Lancaster General Health

Stacey Lee Harris

Director of Operations - Medical Specialty

Urgent Care & Women's and Pediatrics

Penn Medicine Lancaster General Health

Vito J. DiCamillo, M.D.

Medical Director Urgent Care

Penn Medicine Lancaster General Health Physicians

Editor’s note: This timely article is the first of a two-part series. The current article focuses on the consumer demand that has fueled the dramatic growth of urgent care in Lancaster County; the second will examine clinical aspects of the current model used by Penn Medicine LG Health to deliver urgent care.

INTRODUCTION

The launch of retail and urgent care delivery models by Penn Medicine Lancaster General Health (PMLGH), was described in this Journal in 2010.

1 Over the subsequent nine years, the health system opened six urgent care centers: Lancaster (2), Ephrata, Parkesburg, Lebanon and, most recently, Lititz. During the same time period, four PMLGH retail or “express clinics,” the first in Lancaster County, opened in two Walmart and two Giant food stores. Due to low consumer adoption and operational challenges, only one PM LGH Express currently operates in the Giant on Oregon Pike, as a satellite of the Crooked Oak Family Practice.

A NATIONAL VIEW

According to the Urgent Care Association of America, there were 7,639 urgent care centers in the U.S. in 2017.

2 By the year 2020, urgent care is projected to represent a $30.5 billion share of all health care expenditures.

3 While growth has leveled off in some markets, others are still experiencing increases of 6%-10% per annum. Med Express, owned by UnitedHealth Group’s Optum, grew 23% last year and is now partnering with Walgreens to open more clinics adjacent to their drugstores.

2 There has been a general trend towards consolidation in urgent care, as has occurred within the entire health care sector. Private equity firms and large UC companies are acquiring smaller, privately held urgent care providers in order to enhance economies of scale and thus profitability. Hospital systems are either going into UC alone, or are partnering with national chains in order to provide a lower cost care option, to gain covered lives, and to maintain a competitive advantage over other health care systems.

MARKET COMPETITORS

Today, PMLGH leads its service area in providing urgent care. While two competitors, Patient First and MedExpress, have not expanded beyond a single location in Lancaster County, PMLGH added four new facilities in the past five years. One of the first private UC providers in our area, Urgent Care of Lancaster, opened two clinics in late 2000, and both closed in 2011. Wellspan, with a home base in York County, operates a number of UC centers there. After acquiring Ephrata Hospital, Wellspan opened its first Lancaster County urgent care site in Lititz in August of 2018. Ephrata Hospital ceased operating an urgent care center in New Holland it had opened before joining Wellspan, leaving only one clinic in Ephrata near its hospital campus. To the northeast, Tower Health has taken a sizeable position in urgent care with the acquisition of 19 Premier Urgent Care locations in the Philadelphia suburbs. Patient First’s Downingtown clinic is the closest competitor to the PMLGH UC clinic in Parkesburg. MedExpress is currently focused on Dauphin and Lebanon counties.

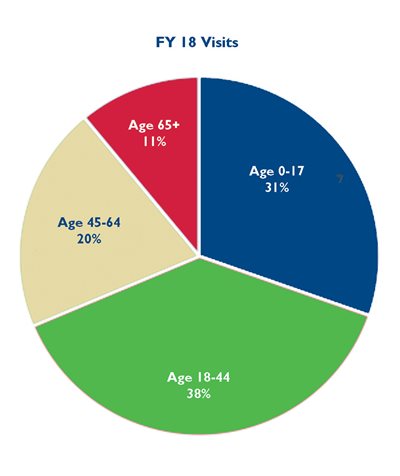

Fig. 1. Ages of patients seen by PMLGH Urgent Care in FY 2018.

URGENT CARE PATIENT DEMOGRAPHICS

More than two-thirds (69%) of PMLGH UC patients are under the age of 45 (Fig. 1). There is strong evidence that millennials, in particular, use urgent and retail clinics for their episodic health care needs. According to a PNC national consumer survey, millennials represent a third of all retail clinic visits and a quarter of urgent care visits nationally.

4 A PMLGH quantitative study of millennial health care attitudes and behaviors confirmed their preference for, and high use of, urgent care. There is also a growing body of evidence which shows that younger millennials, ages 18-25, have little interest in establishing a medical home. This was confirmed by LG Health consumer research, which found that older millennials seek out a primary care practice once they have children. However, across the millennial age spectrum, access, convenience, and price transparency are paramount. Urgent care, retail clinics, and telemedicine are designed to specifically meet those needs.

GROWING USE OF URGENT CARE AMONG BABY BOOMERS AND SENIORS

It would be inaccurate, however, to presume that millennials are the only generation that utilizes urgent care. Lancaster County is one of the largest retirement communities in the country, and a major attraction that brings seniors to Lancaster is its offering of the highest quality health care. While it is true that seniors value the ideal of a trusted and knowledgeable family doctor, if their physician is not available, more of them are seeking out a reputable urgent care provider who can meet their needs, but also keep their PCP informed of the care they have received. This is a rather simple process, and unique to PMLGH UC. Utilizing a standardized template, and EPIC’s Community Connect, summaries of urgent care visits are available to all PCPs, regardless of their affiliation with Penn Medicine LG Health. If the provider is not linked to PMLGH through EPIC, a fax with the attached summary is sent immediately. Because of this seamless connectivity, as well our quality, evidence-based medicine, many non-LGHP primary care practices have made Penn Medicine their UC of choice. Another important factor is PMLGH’s commitment to medication reconciliation using the EPIC platform, which adds another level of safety that physicians and patients have come to rightly expect and greatly appreciate.

Despite the uncontested value of having a medical home, approximately 10% of patients who visit PMLGH’s urgent care do not have a primary care provider. Some other urgent care models offer both urgent and primary care to their patients, but we strongly advise our patients to find a medical home. Utilizing our online tool, we can immediately schedule the patient with a provider of their choice. The goal is to find the practitioner who best meets the patient’s requirements (e.g. male or female, meeting ethnic preferences and or language needs, with evening hours, at a convenient location, etc.) and assure the patient that their medical record will be available to the provider at their first office visit. Our intent is to hand off the patient to the practice seamlessly, with the result being a long-lasting relationship.

As expected, demand for urgent care peaks in the early morning, after school, and in the evening. Mondays, as well as the days preceding or following a holiday, are also very busy. On the weekends, when primary care providers have limited or low appointment availability, or when their offices are closed, urgent care volumes increase. Finally, flu season stresses the capacity of all health care services, including urgent care.

CONSUMER PREFERENCE DRIVES DEMAND

Since opening its first clinic on June 1, 2010, at Spring Valley Road, PMLGH has experienced more than 360,000 patient visits at its six locations. For fiscal year 2019, the projected volume of UC visits is greater than 117,000, up 7.3% from the prior fiscal year. The two key drivers for this exponential growth are convenience and access.

Consumer research conducted by PMLGH concluded that for non-emergent episodic care, most patients prefer to be treated by their primary care physicians. If, however, their PCP could not see them promptly, they would likely use an urgent care center. Fewer respondents reported that they would seek treatment from an emergency department. The increasing prevalence of high deductible health plans provides a strong incentive for patients to seek care in an urgent care setting. A typical UC visit costs less than $200, compared with an ER visit, which averages $1,350 nationally.

The patient with a high deductible is personally responsible for greater out-of-pocket spending. Unless such patients have a catastrophic illness or hospitalization, they will likely be responsible for 100% of their health care costs for the year. Urgent Care is a venue where the cost of care is more predictable and manageable for the patient.

Other key drivers in the consumer’s selection of an urgent care center are:

1. A recommendation from their PCP; within LGHP our practices have come to view UC as an extension of their offices when the office is closed or when same day appointments are not available.

2. An affiliation with a quality health care system. PMLGH is viewed as the premier hospital system in the region; its quality measures, ranked by prestigious national organizations such as Leapfrog, U.S. News & World Report, and Magnet, put LGH in the top seven hospital systems in the country.

3. Connectivity to an electronic medical record that interfaces with the patient’s provider.

With our commitment to continuous process improvement, there is a large-scale initiative to create a note and summary of the urgent care visit that are more concise and more easily accessible to the provider. More than 95% of our urgent care charts are closed within the same day, and almost 100% are closed in three days. The act of creating, closing, and electronically transmitting a well-organized note in real time, results in seamless, less fragmented, safer, and better health care.

The availability of multiple urgent care locations for patients to choose from can add a layer of complexity to the selection process. To help patients access care expeditiously, an on-line reservation tool called Clockwise was introduced in 2015. Using the Clockwise app on their mobile device or computer, patients can see in real time, on one screen, the wait times for each of the six PMLGH UC locations. The patient can then select and “reserve” an available slot in the UC schedule to be seen by a provider.

Approximately 30% of all UC patients currently use the Clockwise tool to schedule a visit. UC centers are strategically located about 15 minutes apart by car, which enables patients to choose the right place and time to be seen, based on availability, geography, and wait times. For example, a patient living in Manheim could choose to drive north to Lebanon, south to Lancaster, or east to Lititz, based on the wait time for the next available appointment. Patients can expect the same quality of care at all the locations, and – most importantly – can be assured that their electronic medical record will be complete and accurate. We can offer truly seamless communication to any provider from all our urgent care locations. It is not uncommon for UC patients to be seen at more than one of our UC practice sites, during the course of a year.

PATIENT SATISFACTION

A 2018 article published in the A

nnals of Emergency Medicine, “Online Ratings of the Patient Experience: Emergency Departments Versus Urgent Care Centers," conducted by Penn Medicine, reported that there were significantly more 5-star reviews on Yelp for urgent care than for ED visits.

5 According to a recent Press Ganey report on patient satisfaction, PMLGH’s urgent care centers outperform its ED in the key loyalty metric of “likelihood to recommend.” It is worth noting, however, that through December 2018 (first half of fiscal year 2019), the patient satisfaction scores for PMLGH’s ED were in the 89th percentile nationally.

EVOLVING THE MODEL

Today, urgent care is accessible to patients throughout Lancaster County a minimum of 12 hours a day, seven days a week (except Christmas day); one location is open 14 hours a day. PMLGH’s UC site opposite the ED on Duke Street offers extended hours, and its new location at the Kissel Hill Outpatient Center offers expanded services, such as IVs, blood work, cardiac monitoring, and concussion testing. Although the availability of urgent care has not dramatically reduced the volume of patient visits to the ED as was originally hoped, it has leveled the growth trajectory of ED lower acuity visits.

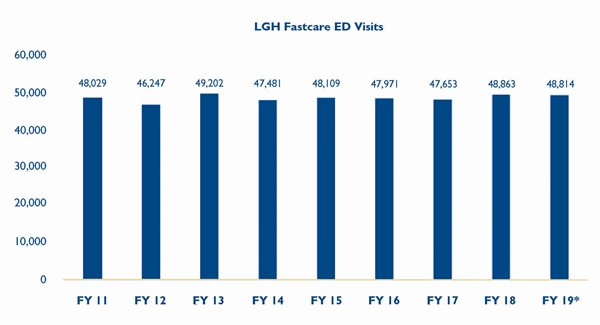

Fig. 2. Number of low acuity visits to PMLGH ED has remained stable since the advent of Urgent Care.

*FY 2019 is projected.

Some industry futurists predict that on-demand telemedicine will erode the need for onsite urgent care. Others argue that with growing shortages of primary care physicians in many markets, there will continue to be future demand for urgent care. Still others believe that virtual urgent care clinics using telemedicine for low-acuity visits will trend upward, and patients will engage directly with urgent care providers through their smartphones.

On the provider side, telemedicine is already proving to be useful in linking physicians and advanced practitioners in multiple urgent care sites for consultations and coverage. PMLGH’s six urgent care sites are connected virtually through Urgent Care to Urgent Care telemedicine, as well as utilizing “store and forward” technology such as Haiku and Cantos. PMLGH Urgent Care is well positioned to respond to consumer demand for urgent telemedicine, once Pennsylvania supports on par reimbursement.

THE NEXT WAVE

There is no question that employers are seeking more ways to reduce their expenditures for employee health care, and are pushing more of the burden of health care costs on to their employees. At the same time, insurance companies see urgent care as a much lower cost option to ED care, and are designing products that incentivize subscribers to use this cost-effective alternative. One insurer, Anthem Blue Cross Blue Shield, instituted a policy that denies coverage for ED visits deemed unnecessary, based on a prespecified list of non-emergent conditions. According to a study reported in the

American Journal of Managed Care, 87.9% of commercially insured ED visits presented with the same primary symptoms as visits that resulted in non-emergent diagnoses.

6 Further, it is estimated that 1 in 6 commercially insured adults would be denied coverage if the policy were adopted by all commercial insurers.

6 In saturated markets, more specialty urgent care centers are emerging that offer pediatric, behavioral health, orthopedic, and dental services. Hybrid urgent care and occupational medicine centers are another popular model.

CLOSING

Consumers, employers, and payers have benefitted greatly from the availability of urgent care services offered by PMLGH throughout Lancaster, Western Chester, and Lebanon Counties, that offer ready access to high quality, convenient, as well as affordable care. In keeping with our mission, PMLGH Urgent Care is committed to bringing innovative, accessible, low cost, high quality, and convenient care to all the communities we serve.

REFERENCES

1. Wynne S, Carr K. Lancaster General Health urgent care and express care.

J Lanc Gen Hosp. 2010; 5(3): 69-71.

2. Japsen B. Urgent care industry hits $18 billion as big players drive growth.

Forbes magazine Feb 23, 2018.

https://www.forbes.com/sites/brucejapsen/2018/02/23/urgent-care-industry-hits-18b-as-big-players-drive-growth/#653c64d896d2

3. Urgent care trends to watch in 2018 – The year of the patient. DocuTAP, Jan. 3, 2018.

https://docutap.com/blog/urgent-care-trends-to-watch-in-2018-the-year-of-the-patient

4. AMN News. Why millennials prefer retail clinics and urgent care.

https://www.amnhealthcare.com/millennials-retail-clinics-urgent-care/

5. Agarwal AK, Mahoney K, Lanza AL, et al. Online ratings of the patient experience: emergency departments versus urgent care centers.

Ann Emerg Med. 2018 (Nov 1). pii: S0196-0644(18)31322-2. doi: 10.1016/j.annemergmed.2018.09.029. [Epub ahead of print]

6. Rosenberg J. Under Anthem policy, 1 in 6 could be denied ED coverage.

Am J Managed Care. In Focus Blog – Published on: October 23, 2018.

https://www.ajmc.com/focus-of-the-week/under-anthem-policy-1-in-6-could-be-denied-ed-coverage