Winter 2016 - Vol. 11, No. 4

The Rising Cost of Prescription Medications

Matthew Eberts, PharmD, MBA, FASHP

Director of Pharmacy & IV Services, Lancaster General Health

INTRODUCTION

The rising cost of medications in the United States is receiving considerable attention, not only in the news, but also in the medical literature, at board meetings of companies big and small, and at kitchen tables around the country (including the tables of pharmacy directors). The surge in the price of Epipen® to $600 is one dramatic and distinctive example, but in fact the costs of medications in general are increasing, and the trend will continue. As health care providers, it is important that we understand not only what is driving those increases, but also their impact on patients and health care organizations.

Total spending on drugs in the United States reached $310 billion in 2015.

1 In the year between June 1, 2015 and May 30, 2016, drug costs rose nearly 10% while the overall inflation rate for the United States was only 1%.

2 This trend of price increases is expected to continue through 2020, as both the cost of medications and the utilization of medications continue to rise.

2 The impact on hospital inpatients has been even greater; from 2013 to 2015 average drug spending per admission increased by 39%.

3

The accelerating inflation in drug prices is driven by a multitude of complex variables, including recent advances by the pharmaceutical industry. Diseases that could only be managed a few years ago are now being cured, and patients with advanced cancer diagnoses are having their lives extended, but these advances come with an expensive price tag. Also, enhanced efforts by the FDA to ensure the safety of medications are driving some of the most dramatic cost increases, even for drugs that have been used for centuries.

In addition, some companies seem to prioritize an unapologetic pursuit of profits. They have abruptly raised the prices of long-established drugs with the justification that their first responsibility is to their stockholders.

THE COST OF MEDICATIONS IN THE UNITED STATES

A detailed review of some of the specific drugs that underwent price increases will illustrate the factors that are driving these increases.

I. The Unapproved Drug Initiative - Colchicine and Neostigmine

The rigorous FDA drug approval process in effect since 1962 is based on the Federal Food, Drug, and Cosmetic act of 1938, which requires evidence of safety and efficacy as the two key elements for approval of a medication.

4 Some medications in current use did not go through the formal FDA approval process, in most cases because they came to market prior to 1962. In 2006 the FDA embarked on a concerted effort to address that gap by requiring that unapproved medications go through a formal approval process that involves clinical trials of safety and efficacy. Though the motivation for this program is certainly laudable, and is rooted in the FDA’s charge to make sure medications are safe, the net effect has been to create some dramatic price increases.

5

Due to this FDA initiative, several old, established, and previously unapproved medications that traditionally had stable prices – both because there were no R&D or marketing costs built into their prices, and because as generics they were usually manufactured by several companies – are now abruptly being priced like new, branded products. After a company completes the newly required studies and receives approval for a medication, the company has 3-7 years of brand exclusivity during which it is the only one approved to market the drug at any price it chooses, even though the medication is well understood, has an established place in care, and requires little if any marketing.

While the FDA acknowledges that this initiative may lead to increased prices in the market place, they reply that their charter from Congress is about safety, efficacy, and labeling of products, not medication pricing.

6

One example is

colchicine, a drug that has been used since the ancient Greeks, and cost no more than 25 cents a day before 2010.

7 By using the FDA’s program for review of unapproved medications, the small pharmaceutical company URL Pharma carried out relatively small scale studies that were sufficient to obtain FDA approval and exclusive rights to the product, and then sold those rights to Takeda Pharmaceuticals, a much larger company, for $800 million. Takeda raised the price dramatically to over $6/pill from the historical price of 10-25 cents. Since this is a drug that is widely used, the impact on state Medicaid programs was an increase in spending for this medication alone from $1 million per year to $50 million per year.

8

Colchicine is primarily used for outpatients, so the burden of increased cost falls mainly on patients and insurers, but there are many examples that more directly impact health-systems and hospitals. Obviously, because of the Diagnosis Related Group (DRG) system of fixed payments for treating a diagnosis regardless of the resources used, any increase in the cost of inpatient medications raises the hospital’s overall cost of care and lowers its margin.

Neostigmine was first patented in 1931 to reverse neuromuscular blockade. Though it is a staple in operating rooms, and is classified by the World Health Organization as an essential medication,

9 it was never approved in the U.S. because it predated the Food, Drug, and Cosmetic Act.

10 In 2013 the FDA approved Bloxiverz™, the first neostigmine product to be formally evaluated, and all other neostigmine products were pulled from the market. Flamel Technologies, the European manufacturer, promptly raised the price of Bloxiverz™ from $3/vial to an initial price of $160/vial. After the FDA approved another manufacturer’s neostigmine product the price of Bloxiverz™ fell, and is currently $56/vial for the hospital. Since neostigmine is used extensively in the operating room, the implications of this price increase have been considerable. During the time when there was only one approved manufacturer, there were also some periods of drug shortage. There has been much discussion about more frugal use of the drug, as well as alternative approaches to neuromuscular blockade.

MERGERS AND PRICE HIKES - NITROPRUSSIDE

Another cost driver is the pharmaceutical industry’s new business model in which a company identifies a pharmaceutical company that has a product or products felt to have a suboptimal pricing strategy. They acquire the company and its portfolio of pharmaceutical products, reduce expenses (mainly by not doing as much, or any, research and development), and focus on “pricing optimization,” which means raising prices significantly. An ideal target for this strategy is a small (and therefore affordable) pharmaceutical company that makes a product that has no competition. This form of value-based investing is a common general business practice, but when it is applied to a critical life-saving medication with no good alternative, the price can be raised dramatically with severe consequences. As pointed out in a New Yorker article by James Surowiecki, it is a “Moneyball” approach to pharmaceuticals.

11 (By that he means that this business model depends on identifying undervalued assets that can be purchased cheaply, just as Oakland A’s manager Billy Beane identified undervalued baseball players who could be paid low salaries.)

Examples of this business model are provided by

nitroprusside and

isoproterenol. These two life-saving heart medications were purchased on the same day by Valeant Pharmaceuticals. These were products made by only one company, and even though they were no longer protected by patent, there were no alternatives. (When the market for a drug is very small there is little incentive for anyone else to create a generic alternative at the existing price point. Indeed, the price would probably fall further if there were competition.) Though the medications were still manufactured in the same plant with no changes to their formulation, the prices were raised 525% for isoproterenol and 212% for nitroprusside on the day of acquisition.

12

Another example of this business model is intravenous acetaminophen. In May 2014, Mallinckrodt Pharmaceuticals purchased Cadence Pharmaceuticals, the manufacturer of injectable acetaminophen (Ofirmev®). At the time of purchase, Mallinckrodt increased the cost of injectable acetaminophen from $14.60 to $35.05 for each 1-g vial. This was a 140% increase over and above the 37% price increase implemented by Cadence during the three years before the company’s acquisition.

13

One of the most notorious examples of this practice, mainly driven by the media attention given to the company’s CEO, is Daraprim® (pyrimethamine). When this product was purchased by Turing Pharmaceuticals in August 2015, the price increased by over 5,500%, from $13.50/tablet to $750/tablet. The medication also shifted from general distribution through wholesalers to closed distribution requiring pharmacies and hospitals to purchase it directly from the company, allowing them more control of the supply and cost. While pyrimethamine is an anti-malarial medication, it is often used to treat toxoplasmosis in AIDs patients and other immunocompromised patients for whom it can be life-saving. It, too, is included in the World Health Organizations List of Essential Medications.

9

These types of changes occur swiftly and without much visibility, often before insurance companies and health-systems can adjust practices to deal with the sudden and significant price increases.

NEW MEDICATIONS–OPDIVO AND PCSK9 INHIBITORS

In addition to the new business strategies discussed above, there is also a more traditional driver of drug costs – new medications. These have long been a driver of increasing costs, but their impact lately has been drastic, especially in the treatment of cancer. For example, the cost of each new cancer drug approved in 2014 was more than $120,000 per year of use.

14,15 Specifically the average cost per month of a branded oncology drug has more than doubled in the last 10 years.

16 Put another way, the inflation-adjusted cost for each additional year of life has gone from $54,000 in 1995 to $207,000 in 2013.

14

An illustrative example is provided by the recently approved anti-cancer drug nivolumab (Opdivo®), a human monoclonal antibody that enhances the immune systems’ response to cancer by blocking the activity of PD-1, a protein that prevents T cells from recognizing and attacking malignant cells.

17 In an 18-month analysis, the median overall survival rate with nivolumab was 9.2 versus 6.0 months for docetaxel. The overall 18-month overall survival rate was 28% for nivolumab compared to 13% for docetaxel.

18 A recent regimen of nivolumab and ipilimumab (Yervoy®), another immunotherapeutic agent, has been gaining traction in the treatment of melanoma and has a price tag of $256,000 if a patient stays on therapy for a year.

19

Although oncology drugs comprise the majority of new medications that are driving costs, there are other categories as well. Two new injectable cholesterol-lowering PCSK9 inhibitors (proprotein convertase subtilisin/kexin type 9) have recently been discussed in detail in this Journal.

20 Their mean cost is around $14,000/year, compared with a cost of less than $100/year for most statin medications. Based upon the outcomes in clinical trials that preceded FDA approval, it has been estimated that these medications could reduce the cost of cardiovascular care by $29 billion over 5 years, but they would increase drug costs by $592 billion.

21 This study estimated that the cost of the drugs would need to be reduced to about 10% of their current cost to realize an overall decrease in the cost of care.

Expensive drugs cause difficult controversies. Because of its dramatically positive clinical results, nivolumab was fast tracked for approval by the FDA, but it has been estimated that it costs $103,000 for an extra seven months of life with Opdivo®.

22 The ethical and fiscal debate on how to put a valuation on three months of human life or a 15% increase in 18-month survival is beyond the scope of this article, but it is an ongoing one that will be difficult to resolve.

THE ROLE OF R&D COSTS

It is relevant to discuss the evolution of the business models for pharmaceutical research and development. In a frequently cited 2009 paper, the pharmaceutical industry claimed that it costs $1.32 billion to bring a new drug to market.

23 This figure was debunked in a 2011 study that took a closer look at that number and the data behind it. The authors found that the number cited by industry includes taxpayer subsidies, and exaggerates trial lengths and other financial variables that may overstate the actual cost of drug development as much as tenfold.

24

Furthermore, many of the new agents coming to market today were not actually developed by the large pharmaceutical companies that are currently marketing them. Nivolumab was discovered by a small company called Medarex that was founded in 1987 primarily to do biomedical research, but it was purchased by Bristol Myers Squibb in 2009 for $2.4 billion.

25 The history of nivolumab followed a pathway that is now common for many new pharmaceuticals. The drugs are developed at small research companies, and once the drugs show promise or gain approval, the company is purchased by a large pharmaceutical company that launches them into the market.

SPECIALTY PHARMACEUTICALS - THE HEP C EXAMPLE

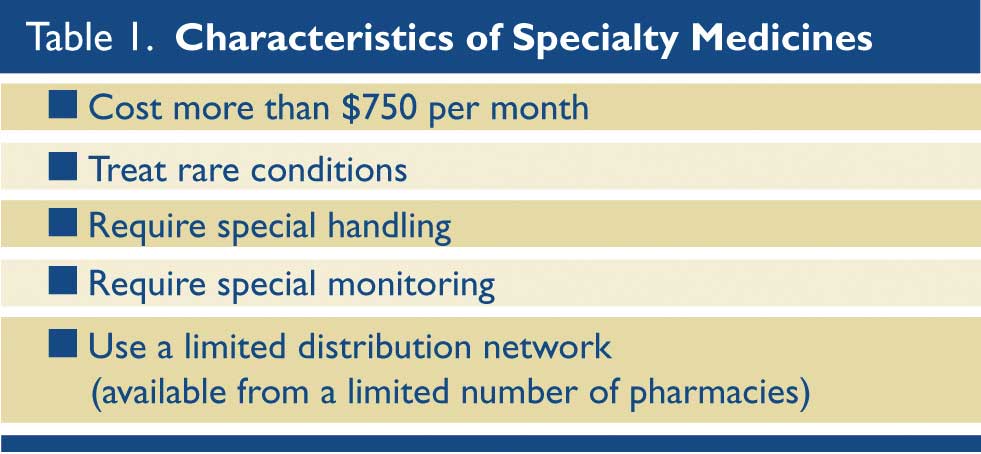

The rise in the availability and utilization of specialty pharmaceuticals is another primary driver of increased drug costs. There is no formal, comprehensive definition of a specialty medicine, but for this discussion the criteria in Table 1 will be used. Specialty pharmaceuticals are often distributed through a narrow supply chain, i.e. only by a few pharmacies, and have specific programs for reimbursement, patient education, and patient monitoring. They have been most commonly used for inflammatory diseases, multiple sclerosis, cancer, HIV, and Hepatitis C. (Table 1)

Among the reasons why manufactures and insurers use the specialty pharmacy model for certain medications are: easier access to data, compliance with specific monitoring and education requirements, and easier management of co-pays. As of 2016, specialty medications account for 40% of all prescription medication spending in the United States, and that figure is growing.

26 Some examples of the specialty drugs that are causing the most spending are Humira®, Enbrel®, and Remicade®, each with sales estimated to be over $4 billion in 2018.

27

Hepatitis C provides an interesting perspective on how specialty pharmaceuticals are impacting drug spending. As discussed in a recent article in this Journal, Hepatitis C can now be cured.

28 This dramatic development comes at a high cost – in some cases as much as $100,000 for a complete course of medications – which is covered to some degree by health insurers and Medicare, though not by some state Medicaid programs. Patients are responsible for co-pays, which can be substantial, and for many patients, unaffordable. The drug manufacturers, responding to intense public pressure, have offered a variety of programs for assistance to those who cannot afford the drugs.

IMPACT at LGH

Lancaster General Health is no exception in being impacted by the rising costs of medications. In general, cost increases for LGH have matched industry trends, but some of the impact has been mitigated through active management and appropriate revisions of care plans. A few of the specific examples are reviewed here in more detail.

Isoproterenol

The cost of

isoproterenol (Isuprel) is now around $1,300/bag, so the medical staff and the pharmacy staff have taken deliberate steps to make sure this medication is only used in cases where it is clearly the best option. Even so, there remain clinical situations in which it is the most appropriate agent, and 79 patients were treated with a total of 118 bags of isoproterenol between June 1 and October 23, 2016. The total cost for that quantity of the drug was more than $150,000, whereas prior to the purchase of its manufacturer by Valeant and re-pricing, the total cost would have been around $25,000.

Acetaminophen

Intravenous

acetaminophen is another agent that has undergone intense review in health-systems around the country because it may be useful in programs that seek to decrease opioid usage. However, some organizations have decided that the price/benefit ratio no longer justifies using it. At LGH the product is on formulary with restrictions that limit its utilization. Based upon current utilization and pricing, LGH is on track to spend over $500,000 on this one product in FY17. The Pharmacy and Therapeutics committee is performing an evaluation of its usage and outcomes.

Nivolumab

Usage of

nivolumab is expanding rapidly everywhere, and LGH is no exception. To assure that its use is paid for, it is only used at our cancer center for outpatients whose reimbursement is not restricted by inpatient DRG payments. In the first 3 months of FY17, LGH purchased over $1.1 million of nivolumab. The Ann B. Barshinger Cancer Center follows guidelines of the National Comprehensive Cancer Network, as well as evidence-based care plans that are reviewed by the medical team and the pharmacy to ensure they are appropriate. The expanding approval for this medication for additional types of cancer and the general growth in the volume of cancer care assure that this drug and those like it will have an increasing impact on costs.

POTENTIAL SOLUTIONS

Management of the rising cost of medications will depend upon a combination of changes, not only at the local level, but also changes in the pharmaceutical industry to create a more sustainable pricing model.

I. Local Actions

Health care systems will need to be deliberate and purposeful in managing the cost of medications. Locally this will mean attentive monitoring to detect dramatic price increases in long-standing products, and focusing on high cost agents to make sure they are used appropriately. Organizations will need to perform internal reviews of medication utilization, and - following implementation of new agents - calculations of return on investment based on real-life data. Medications should be approved through the Pharmacy & Therapeutics Committee via a formal process that looks at outcomes in external clinical trials, but also conducts a follow up review of internal outcomes to validate that the anticipated results were achieved. For example, if introduction of a new agent was justified by a purported shorter length of stay, we need to evaluate whether we realized that shortened length of stay at LGH.

Another key element of managing drug costs is the establishment of evidence-based care pathways throughout the organization. These pathways will be vetted by experts in the particular area, and – especially for expensive drugs – will allow a deliberate, evidence-based approach specifically aimed at patients who will benefit from the product.

In the current health care environment, health-systems need to think holistically and not just focus on care of the patients when they are admitted to the hospital. Population health and risk sharing initiatives require optimal drug utilization for outpatients as well. Many believe that the future of outpatient care, including cancer care, is going to included bundled payments similar to inpatient DRGs, and these will require a thoughtful approach to outpatient medication management.

II. Global Solutions

The following suggestions from the author for reducing the rising costs of medications at a national level are shared by many thought leaders including an op/ed piece in Time Magazine published by Scott Knoerr, the Chief Pharmacy Officer for the Cleveland Clinic.

29

a. Direct-to-consumer advertising for pharmaceuticals should be banned. This is a recommendation supported by The American Medical Association and the American Society of Health-System Pharmacists. Pharmaceutical companies spent $5.4 billion on direct-to-consumer ads in 2015.

30

b. The practice of “pay-to-delay” should be eliminated. This is a maneuver that brand name drugs use to delay competition from generic products. Brand-name manufacturers will pay generic manufactures to delay the release of generic medications to the market, effectively extending the exclusivity period they have for the medication.

c. Eliminate co-pay assistance cards and programs. While in the short term these reduce a patient’s out of pocket co-pay, they encourage the use of brand medications over lower cost alternatives, and those costs are still paid ultimately by the patient’s insurance premiums and by their employers.

d. The FDA should establish a process to allow the importation of medications on a case-by-case basis when the medication has been impacted by significant price increases.

CONCLUSIONS

This review of the drivers of drug cost inflation, with some specific examples of each, provide a background for understanding the increased cost of medications in the U.S. There are many more examples for each category, but each would follow the same playbook.

For a health-system to best manage its resources and optimize care of patients, it must have an understanding and a plan for dealing with rising medication costs. The plan must include partnering with payers to make sure reimbursements reflect acquisition prices; partnerships with the medical staff and pharmacy staff to evaluate the best use of medications; and partnering with patients so they understand the implications for their personal finances. Another key aspect will be continuing to advocate for appropriate drug pricing and continuing to educate key stakeholders. The primary driver for medication selection will always be what is best for the patient, but fulfilling that objective is being made more complicated as we continue to see dramatic increases in the costs of medications.

REFERENCES

1. www.imshealth.com/en/about-us/news/ims-health-study-us-drug-spending-growth-reaches-8.5-percent-in-2015

2. www.time.com/money/4406167/prescription-drug-prices-increase-why/

3. www.statnews.com/pharmalot/2016/10/11/hospitals-drug-prices/

4. http://www.fda.gov/drugs/guidancecomplianceregulatoryinformation/enforcementactivitiesbyfda/selectedenforcementactionsonunapproveddrugs/default.htm

5. www.fda.gov/Drugs/GuidanceComplianceRegulatoryInformation/EnforcementActivitiesbyFDA/SelectedEnforcementActionsonUnapprovedDrugs/ucm118990.htm

6. http://blogs.fda.gov/fdavoice/index.php/2015/04/reducing-the-number-of-unapproved-drugs-while-working-to-prevent-drug-shortages-a-job-that-calls-for-strong-collaboration-in-fda/

7. www.bloomberg.com/news/articles/2015-10-06/2-000-drug-price-surge-is-a-side-effect-of-fda-safety-program

8. www.latimes.com/business/hiltzik/la-fi-mh-the-little-known-fda-program-20150923-column.html

9. WHO2015E_2-0"19th WHO Model List of Essential Medicines (April 2015)" (PDF). WHO. April 2015. Retrieved May 10, 2015

10. Aeschliman, JA., U.S. Patent 1,905,990 (1933).

https://www.google.com/patents/US1905990

11. www.newyorker.com/business/currency/valeant-why-moneyball-failed-in-the-pharmaceutical-industry

12. www.wsj.com/articles/pharmaceutical-companies-buy-rivals-drugs-then-jack-up-the-prices-1430096431

13. http://drugtopics.modernmedicine.com/drug-topics/news/when-iv-acetaminophen-costs-skyrocketed-one-health-system-did-some-new-math?page=full

14. http://dx.doi.org/10.1016/j.mayocp.2015.06.001

15. www.houstonchronicle.com/news/houston-texas/houston/article/MD-Anderson-doctor-planning-online-petition-6083743.php.

16. IMS Institute for Healthcare Informatics. Innovation in Cancer Care and Implications for Health Systems. May 2014.

www.obroncology.com/imshealth/content/IMSH_Oncology_Trend_Report_020514F4_screen.pdf

17. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.737.256&rep=rep1&type=pdf

18. www.curetoday.com/articles/survival-benefit-with-opdivo-sustained-in-squamous-nsclc

19. www.wsj.com/articles/fda-approves-bristol-myers-yervoy-opdivo-for-treatment-of-melanoma-1443711746

20. Andersen L, Ibarra J, Andersen RL. PCSK9 Inhibitor approval: a new era in lipid management. J Lanc Gen Hosp. 2015; 10: 106.

21. Kazi DS, Moran AE, Coxson PG, et al. Cost-effectiveness of PCSK9 inhibitor therapy in patients with heterozygous familial hypercholesterolemia or atherosclerotic cardiovascular disease. JAMA 2016; 316:743-753

22. http://www.chrisbeatcancer.com/immunotherapy-drugs-new-hope-or-more-hype/

23. PhRMA. (2009) Pharmaceutical Industry Profile 2009. Washington DC: Pharmaceutical Research and Manufacturers of America.

24. Light D & Warburton R. BioSocieties (2011) 6: 34. doi:10.1057/biosoc.2010.40

25. Allison M. Bristol-Myers Squibb swallows last of antibody pioneers. Nat Biotechnol. 2009 Sep;27(9):781-3. doi: 10.1038/nbt0909-781. PMID 19741612

26. www.imshealth.com/en/about-us/news/ims-health-forecasts-global-drug-spending-to-increase-30-percent-by-2020.

27. Pembroke Consulting Analsysis of World Preview 2013, Outlook to 2018. EvaluatePharmacy, July 2013. Published on Drug Channels (

http://www.drugchannels.net) on August 13, 2013.

28. Gibas AL. 25 Years of Hepatitis C: Updated Concepts and Treatment. J Lanc Gen Hosp. 2014; 9 (1):21-25

29. http://time.com/4475970/stop-immoral-drug-prices/

30. http://adage.com/article/advertising/top-200-u-s-advertisers-spend-smarter/304625/